- European tech receives far less funding than US counterparts ($52B vs $170.6B in 2023)

- Strict EU regulations forced innovation in privacy, security, and compliance technology

- European companies now lead in areas becoming globally critical: sovereign cloud, privacy engineering, RegTech

- Regulatory constraints created technical advantages as digital sovereignty concerns spread worldwide

- European expertise in multi-jurisdictional compliance positions companies well for global expansion

European tech companies receive a fraction of the venture funding that flows to Silicon Valley. In 2023, US venture capital investment reached $170.6 billion, while European startups received $52 billion. Yet despite this funding disparity, European tech has developed world-leading expertise in several critical areas.

The difference isn’t accidental. It’s strategic advantage born from necessity.

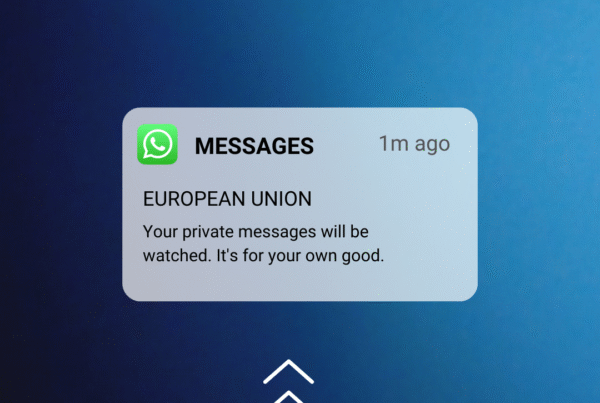

Innovation through regulation

European companies didn’t choose to become experts in privacy engineering and regulatory compliance: they had to. Operating under GDPR, strict data protection laws, and complex cross-border regulations forced European developers to solve problems their American counterparts could largely ignore.

This regulatory pressure created something unexpected: technical expertise in the exact domains now becoming essential as global priorities shift toward privacy, security, and digital sovereignty.

While US companies built fast and moved quickly, European companies built carefully and moved compliantly. That difference now matters more than ever.

Where Europe leads

Privacy by design engineering

European companies architected systems around privacy requirements from the ground up. These solutions go beyond compliance checkboxes to fundamental system design that protects user data while maintaining functionality.

Companies like Nextcloud, Proton, and Tutanota developed sophisticated privacy-preserving technologies years before “privacy-first” became a Silicon Valley marketing term. Their solutions handle complex scenarios like cross-border data transfers, granular consent management, and zero-knowledge architectures because European regulations demanded it.

Sovereign cloud infrastructure

European cloud providers had to solve sovereignty challenges long before most American companies understood what digital sovereignty meant. Providers like OVHcloud, Scaleway, and regional specialists developed technologies for keeping data within specific jurisdictions while maintaining cloud flexibility.

European security providers excel at identity management across complex organizational structures, fine-grained access controls, and audit trails that satisfy multiple regulatory frameworks simultaneously.

B2B security solutions

European B2B security companies developed approaches that assume hostile regulatory environments, complex compliance requirements, and multiple stakeholder interests. This created solutions that are inherently more robust than those designed for simpler regulatory contexts.

European security providers excel at identity management across complex organizational structures, fine-grained access controls, and audit trails that satisfy multiple regulatory frameworks simultaneously.

Regulatory technology (RegTech)

Perhaps nowhere is European technical leadership more obvious than in regulatory technology. European RegTech companies understand compliance not as an afterthought but as a core system requirement that drives technical architecture decisions.

These companies built solutions for navigating GDPR, financial services regulations, healthcare compliance, and cross-border data governance long before similar challenges became pressing concerns in other markets.

What’s our advantage?

This regulatory-driven innovation created unexpected competitive advantages as global priorities shifted. What seemed like European disadvantages — complex regulations, fragmented markets, compliance overhead — actually forced the development of sophisticated solutions to fundamental problems.

Technical depth over speed

While US companies optimized for rapid growth and user acquisition, European companies optimized for sustainability, compliance, and long-term viability. This created deeper technical expertise in complex problem domains.

Multi-stakeholder design

European companies learned to build systems that satisfy multiple stakeholders with conflicting interests: users, regulators, governments, and business requirements. This complexity created more sophisticated architectural approaches.

Cross-border expertise

Managing technology across multiple European jurisdictions required solving problems that most American companies haven’t encountered. European tech companies became experts at managing complexity that’s now becoming universal.

Why this matters now

Global technology priorities are shifting toward exactly the areas where European companies have the deepest expertise. Digital sovereignty concerns are intensifying worldwide. Privacy regulations are expanding globally. Security requirements are becoming more sophisticated.

The “post-surveillance economy” emerging from growing privacy awareness, regulatory pressure, and geopolitical tensions favors companies with deep expertise in the technical challenges Europe has been solving for years.

Regulatory expansion

Privacy regulations similar to GDPR are being adopted worldwide. Companies that learned to navigate complex European requirements have technical and operational advantages in these new markets.

Sovereignty demands

Governments worldwide are demanding more control over their digital infrastructure. European companies that solved sovereignty challenges for EU requirements now have exportable expertise.

Security priorities

As cyber threats become more sophisticated and consequential, the robust security approaches developed under European regulatory pressure become more valuable globally.

Beyond funding gaps

The venture funding disparity between Europe and the US often dominates discussions of tech competitiveness. But funding advantages don’t automatically translate to technical superiority in complex domains.

European companies may have raised less money, but they’ve solved harder problems. They’ve developed expertise in areas that are becoming strategically critical as technology priorities evolve beyond pure growth metrics.

Quality over quantity

European tech companies often focus on sustainable business models rather than venture-funded growth at any cost. This creates different technical priorities and often more robust solutions.

Problem-solving focus

Regulatory constraints forced European companies to become excellent problem solvers rather than just market expanders. This technical depth creates competitive advantages in complex domains.

The path forward

European tech’s regulatory-driven expertise positions it well for a world where privacy, security, and sovereignty are becoming universal concerns rather than regional peculiarities.

The companies that learned to build sophisticated solutions under European regulatory pressure now have technical advantages as similar requirements spread globally. What seemed like constraints became capabilities.

This doesn’t mean European tech companies should ignore growth and investment opportunities. But it does mean recognizing that European tech has developed world-leading expertise in the domains that matter most for the next phase of digital infrastructure development.

The future belongs to companies that can balance innovation with responsibility, growth with sustainability, and technical capability with regulatory sophistication. European tech companies have been practicing this balance for years.